Opportunity Zones

What are opportunity zones?

The Opportunity Zones incentive is a new community investment initiative established by Congress in the Tax Cuts and Jobs Act of 2017 to encourage long-term investments in low-income urban and rural communities nationwide. Opportunity Zones provide a tax incentive for investors to re-invest their unrealized capital gains into dedicated Opportunity Funds. (Information sourced from Economic Innovation Group)

Why were opportunity zones created?

Per the Economic Innovation Group (https://eig.org/), Most metro areas are seeing more local businesses close than open every year. In fact, EIG’s research finds that five metro areas alone produced as many new businesses as the rest of the country combined from 2010 to 2014. The average distressed community saw a six percent decline in local businesses during the prime years of this economic recovery.

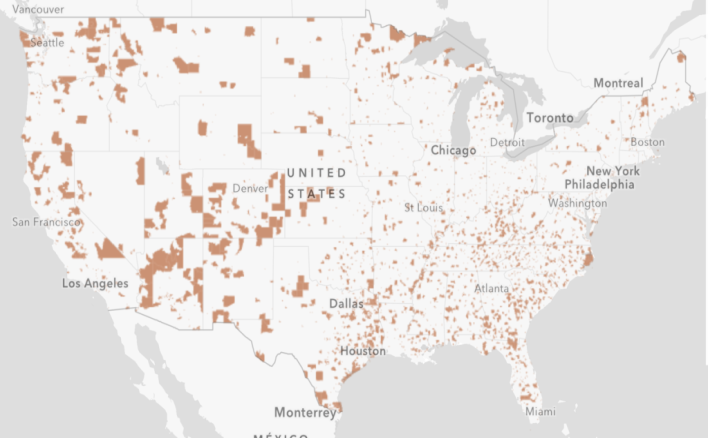

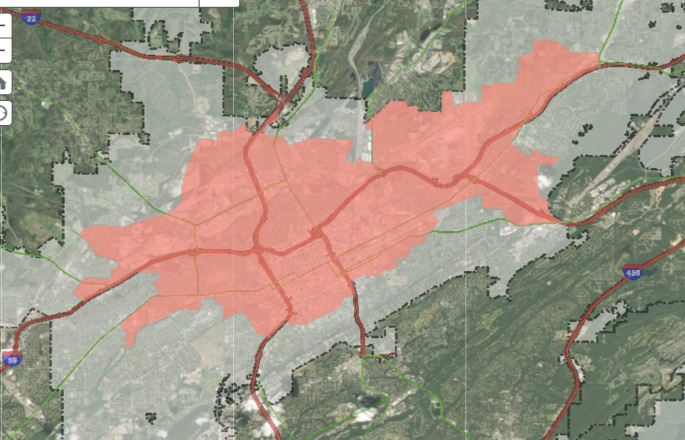

Where are they located?

In the first picture, you can see where all of the opportunity zones are located in the United States. In the second picture, you can see the opportunity zone here in Birmingham.

Photos courtesy the Economic Innovation Group and the City of Birmingham

How Would the Investment Work?

If you sell a piece of real estate or stock and have appreciated gains, you generally have 180 days to reinvest in an opportunity zone property or business. Once you invest in an opportunity fund that buys a property in an opportunity zone, the gain from the original investment is tax deferred until you sell the property or 2026, whichever is earlier.

If the fund holds the property for 5-6 years, you get 10% off taxes due on the original investment. If the fund holds the property for 7+ years you get 15% off that original tax. Tax is due on original gain when you divest or 2026.

If you cash out of the opportunity fund after 10+ years, you pay no tax on the appreciation of the funds in the opportunity zone. At all times 90% of the funds must stay in the opportunity fund in qualified property which will be tested twice a year.

It may be best to consider real estate investments in qualified opportunity zones with redevelopment prospects as substantial improvements are required if the fund chooses to change the property’s original use. For instance, a fund purchases a building for $1MM. Of the purchase price, 60% is allocated to the building value ($600k) and 40% is allocated to the land value ($400k). During any 30-month period, a fund must substantially improve the property by increasing the adjusted basis in the building by whatever the adjusted basis is at the beginning of the 30-month period. In this example, an additional $600k of substantial improvements is necessary in the first 30-months after the purchase. Therefore, if the fund spends $750k in 15 months to redevelop the building and build out spaces for incoming tenants, it satisfies the substantial improvement clause. (Information sourced from Withum.com)

There are many more details and nuances to opportunity funds/zones. We cannot come close to fitting every detail in this blog. Please consult a qualified attorney and accountant when considering an investment in opportunity funds.

An Example of how the Numbers really work

Joe Smith has Wal-Mart stock that he paid $300 for and is now worth $1,300. Joe sells the stock and invests the gains of $1,000 in OZ fund from 2019-2029.

Joe defers the $238 tax due on the gain (assuming he is in highest tax bracket where capital gains are 20% and he is subject to the Net Investment Income tax of 3.8%) until 2026. In addition, his tax burden is reduced an additional 15% so the $238 becomes $202. Now let’s say that the $1,000 gain that was invested triples in the OZ fund. Joe makes $2,000 tax free when he divests in 2029.

Just imagine for a second, the dollars saved, if the example started with $300,000 paid and now worth $1,300,000. For high net worth individuals or large transactions this regulation is a turbo booster for your investment returns.

Why I am sharing this information with our friends and clients?

At IVP, we specialize in the exact location of the opportunity zone in Birmingham. We have performed dozens upon dozens of transactions in this area. What is remarkable is that the zone we have in Birmingham is not distressed in my opinion. This this law was passed using data from the 2010 Census, when Birmingham’s city center was struggling and a ghost town. The zone in Birmingham is now seeing growth, perhaps transforming, if not booming.

If you have a capital gain event in the recent past or coming in the near future and want to defer taxes, please give us a call. We can help you find a good real estate deal in our opportunity zone and can connect you with some experts for the intricate details and nuances of this new regulation.